Weekly Market Overview November 28, 2021

Nov 27, 2021This weeks was an abbreviated holiday week for the US Markets, but it certainly wasn't without drama.

The new strain of CoVid identified in South Africa brought immediate response by the markets on Friday.

All 11 S&P 500 Sectors were down over -1%, except for healthcare ($XLV) which was down but not a full percent.

Energy took it the worst, down more than -4% on the day, with financials a close second -3.32%

Currency markets reacted as well, with $USDJPY down nearly 2%, which is very uncommon. The last time we've had a >-2% down day was March 8, 2020, at the beginning of CoVid selloff in March 2020. Interestingly that day marked the bottom of the selling for USDJPY, but the US Equity markets didn't bottom for another two weeks.

Offsetting all other heat we took on Friday, we were long $PFE Pfizer since November 15th, and on the new CoVid news hitting the market, $PFE was up over 6% on the day.

And yes, $PFE is a Swing Beast trade, how'd you guess! Grab the Black Friday/Cyber Monday deal on the Swing Beast Strategy for 50% off!

Normally I wouldn't be too concerned with some selling on a low volume holiday week, and it may be nothing, but when you have MORE volume on a 1/2 day, the day after a holiday, than you get during any normal week, that makes me take notice.

On top of that, the price action, my preferred method to analyzing markets, shows that the markets opened on a big gap lower, then continued to sell off all the way to close the day (and week) on its lows.

Now it could be nothing and maybe a bunch of people knew they were going to be out of town, or away from their office and thought they'd put in some protective stops that were far enough away that unless the world was ending, nothing would happen. Then with the low volume prices dropped quickly because all of these stop orders were just sitting there, while everyone was watching Football and nursing their hangover.

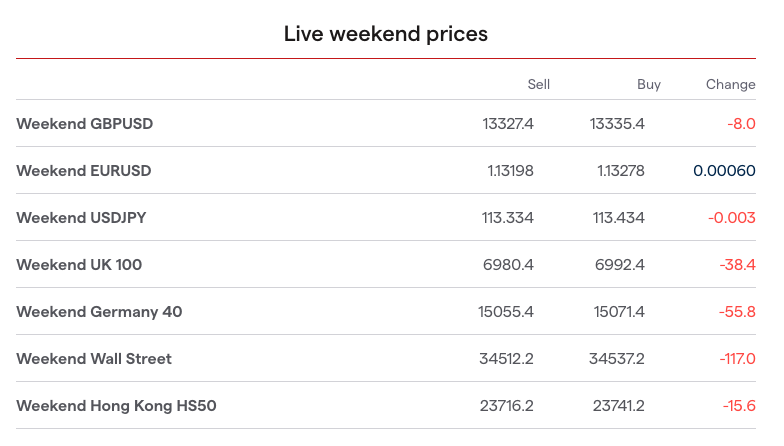

At the moment, Sunday morning, the weekend trading betting markets don't show any too worrisome. I will be watching the Globex open for futures and currencies this afternoon.

I'd love to confidently claim to buy the dip, that we are in Bull Quiet so just buy the weakness. Until proven otherwise we are in Bull Quiet Regime, and yeah you should look to buy the weakness, but as I mentioned earlier this week, we need to wait and look for the REACTION TO THE ACTION.

The initial action was the market sold off on Friday on this new CoVid news.

Our job is to watch and see how the market reacts to that. It doesn't matter what the news is, it doesn't matter that it sold off.

The thing about Bull Markets, specifically the Bull Quiet Market Regime, we get very convincing selling pressure over and over. People get convinced that prices are too extreme, that they just bought the absolute market top, and everyone is scared that things have been too good for too long and it's time for a pullback.

People sell in fear, or never buy because when a pullback does come in they are convinced that the market is going to go substantially deeper than the most recent pullback and miss it.

As a friend pointed out to me, the reason it's called a Bull Market, not because it's easy to buy and hold on to trades, a bull isn't a good description of the type of animal that is easy and gentle.

It's called a bull market because it's wild, always bucking around in herky jerky directions, spinning and thrusting...always trying to buck you off.

To me this means that this scare we had might last a little bit but likely we'll have an opportunity to add to our positions as we always do with pullbacks in bull quiet market regimes.

When that opportunity comes, is to be determined. We'll be tracking it closely every day in the Trading Lab!

If you'd rather not focus on the crazy gyrations of the market day to day and week to week, and would rather trade a simple swing trading strategy that catches big moves before they take off, check out the Swing Beast Momentum Strategy.

That is exactly what we do, we find what's ready to take off, and jump on for a quick ride! Like this one on $PFE

We had no idea the FDA was announcing approvals or that a new strain of CoVid was going to take over the newsfeed, we were positioned ahead of all that.

We had no idea that $AAPL was going to start talking about their Electric Vehicle...again. But we were well positioned ahead of all that.

It certainly doesn't work on every trade, for example here's $AMAT, one that we are currently in and has gone against us.

By trading a specific type of options strategy, we turn a 10 point loss in the stock to a minor loss, with plenty of time still left in the trade until we look to exit.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.