Weekly Market Overview January 23, 2022

Jan 23, 2022|

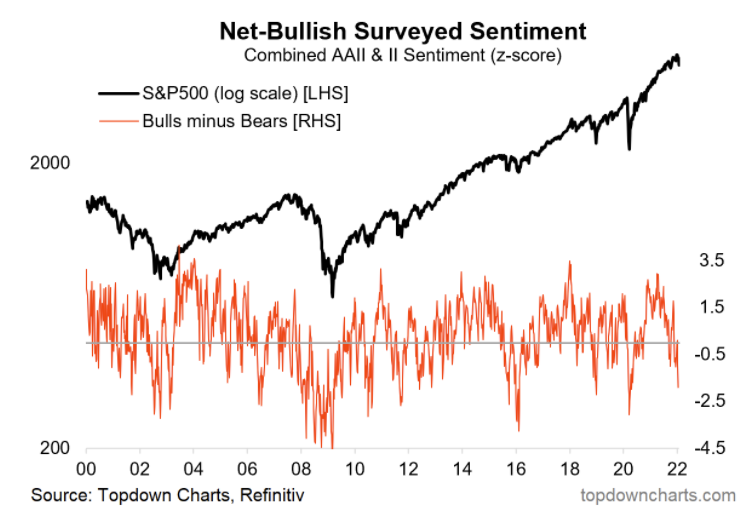

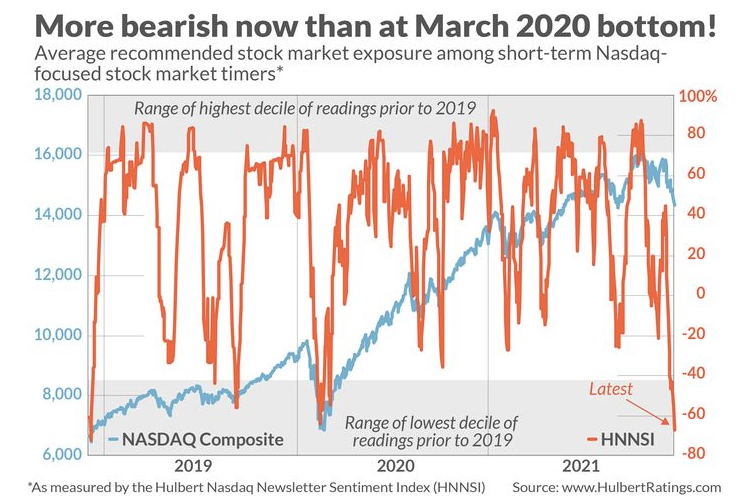

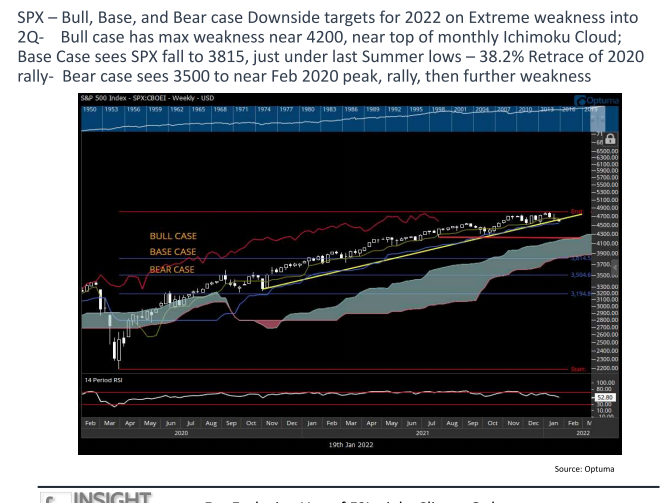

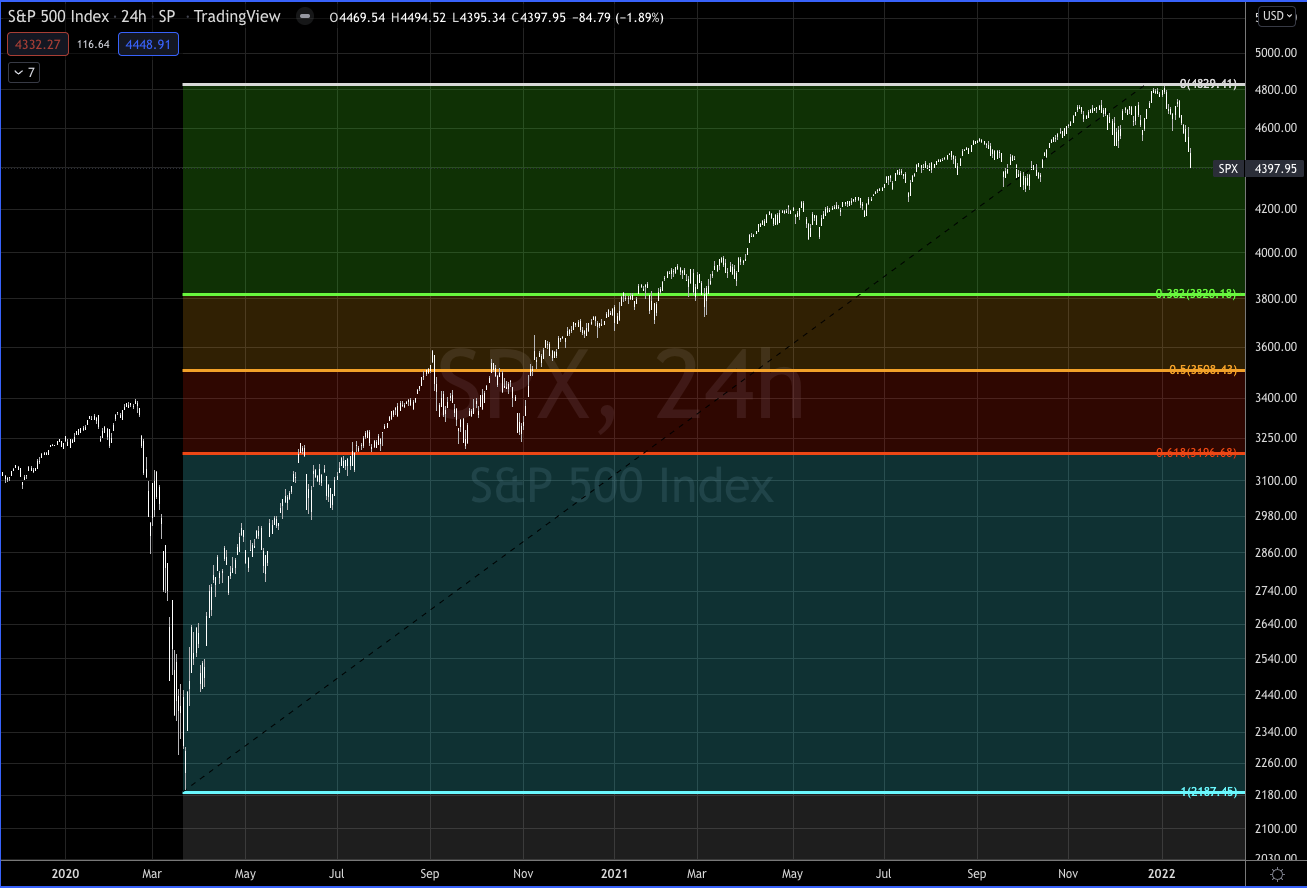

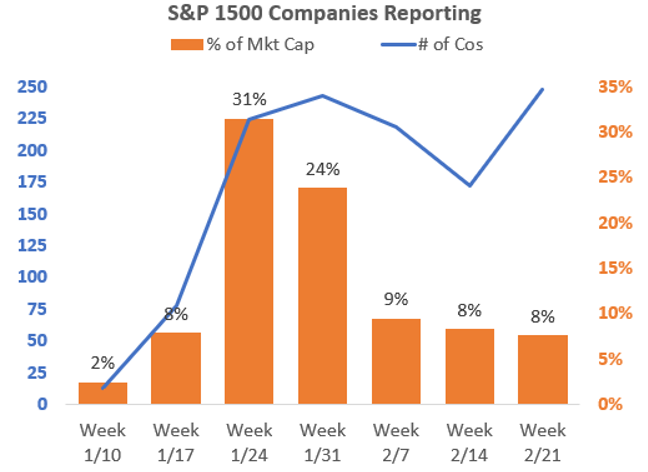

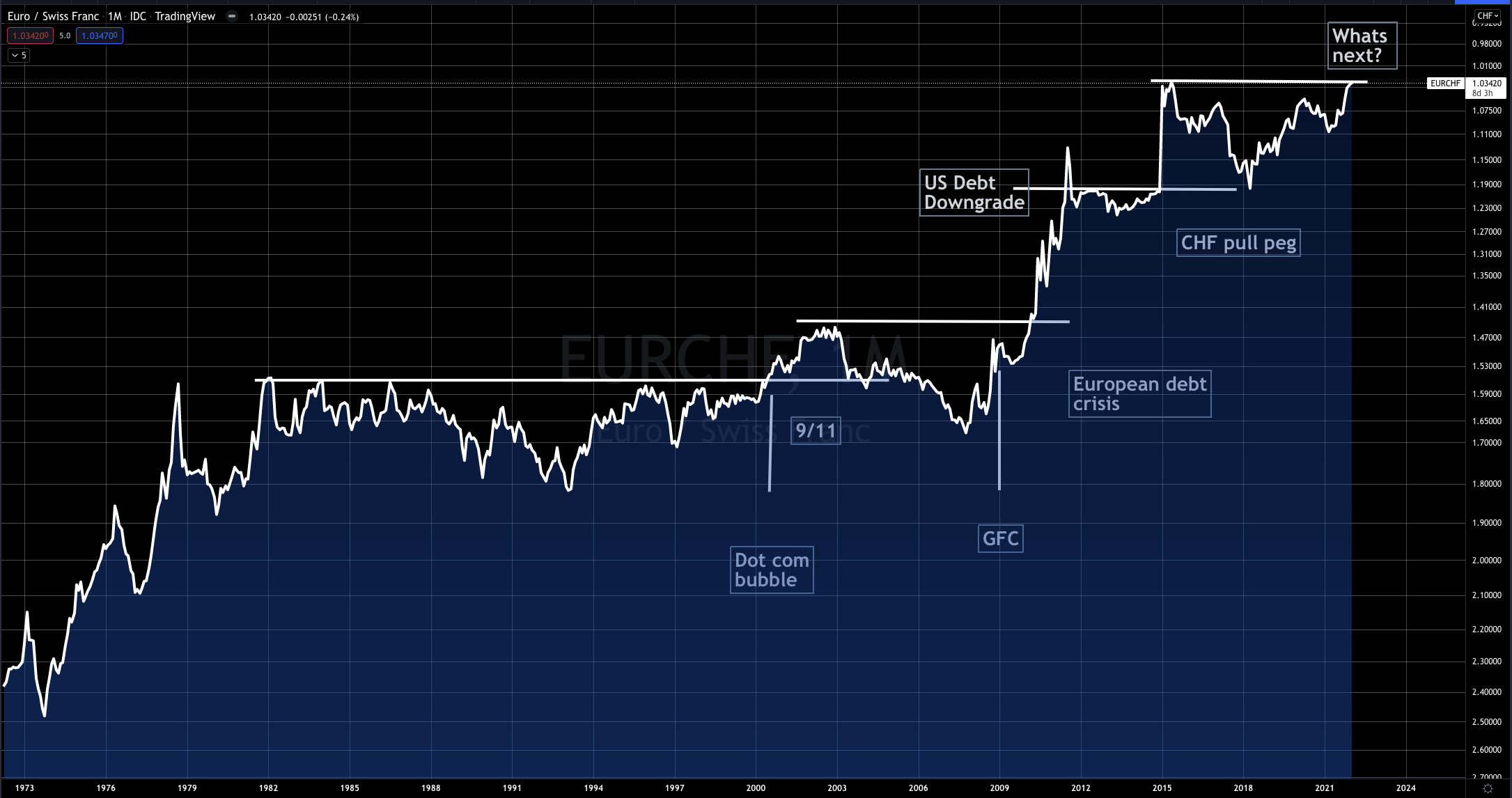

It got hairy out there and fast, this past trading week. Every attempted rally was reversed and sold in to, closing near the lows of the day for all four trading sessions of this shortened week. When analyzing price action that is the definition of decisive strength in the direction of trade. In this case, straight down. This is the complete opposite of what we saw since around the November 2020 lows during the US Presidential Elections. Since then, the market has been on a tear higher, until 2022. What's interesting is the speed at which sentiment has changed, down to levels last seen at the bottom of March 2020 selloff, Q42018, right before the 2016 presidential election, European Debt Crisis, US Debt Downgrade, Global Financial Crisis, Housing Bubble, 2001-2003 Recession and 9/11. And even more interesting is that price on the $SPX (S&P 500 Index) has only dipped down 10% from all time highs, that's minor correction territory, nothing compared to the Pandemic or Global Financial Crisis. As I mentioned last week, and the week before, 2018 was the last time the Fed started both raising rates and easing the balance sheet. in 2022, today, the Fed has just started indicating that they will start raising rates and ease the balance sheet. A different sentiment survey by Hulbert Ratings surveys Nasdaq short-termed focus market timers (Me!), has sentiment below the March 2020 pandemic lows and in the far left corner you can see we are as bearish as the 2018 bottom. My buddy Seth Golden (https://twitter.com/SethCL) shared a chart from Fundstrat showing three price levels for the bullish case, base case and bear case downside targets on the $SPX. This brings up an interesting point that I don't often use, but since so many market participants do that it's worth noting, the Fibonacci retracement. Since the March 2020 lows, we have not retraced even 38.2%, let alone had a healthy 50% retracement. The key levels to watch on $SPX are: I'm not a big user of Fibonacci levels, but I guarantee there will be a LOT of money deployed long at each of those levels if they are seen. How are we positioned? We are currently positioned 70% cash and net short $QQQ via puts and a small speculative position in $GME via puts, (yeah the new safe haven for the market is $GME, that's wild man!). We took profits on our $HAL long position after a Swing Beast Trade, recall last week this position was up 180%, our trail stop rules exited +100%. With a 70% cash position we have a lot of opportunity to get positioned if we do find a bottom and start cycling higher. This week IS THE WEEK for earnings, with 31% of all S&P 500 companies reporting this week including all the big growth names, with another 24% reporting next week, this is the place we should stop the bleeding, if we do. Last week $NFLX (Netflix) missed on earnings and got clobbered over -24% in one single day. This was a quarter of a trillion dollar company at a 25% discount in one day. That isn't normal market behavior. We already know the pandemic stars, $PTON, $NFLX et al, are being decimated, the question remains are the rest of the growth names ready for the same? All it will take is one other big name to miss big and we might be in for a continued rough start to the year. This whole mess started with the Federal Reserve becoming hawkish and talking about three rate hikes this year and cutting the balance sheet. They said they would begin in March, but a number of speculations has been that the Fed might announce a 50 basis point cut as soon as this week! Going in to this week the $SPX has sold off about 10%, one of the biggest FAANGM stocks got destroyed, on top of fears of an aggressive Fed, and if any of those fears aren't met we might have ourselves a recovery underway. If that happens we'll have another setup for the Swing Beast Strategy to step in and put that 70% cash to good use!!! Macro One of the most important charts I'm watching is the $EURCHF (Euro/Swiss Franc) pair. And we are at historically low levels on the pair. (INVERTED $EURCHF) The pair shows very long term strength in the Swiss Franc and lot's of selling out of Euro's. When would you want to own Swiss Francs instead of Euro's or Dollars? Switzerland is a small country but due to its banking system it is a major player in the world currency stage. The Nazi's in WW2 stored their vast wealth, stolen from Jewish refugee's and conquered countries alike, in their Swiss Banks. At the same time, those Jewish refugee's and families of Nazi conquered countries also stored their money, art and jewelry in the same Swiss Banks. That is a fascinating part of the World War 2 story, as are a million other stories, something you'd expect from the biggest war in history. When there is Geopolitical tension there are plenty of things to keep an eye out for, but when there is Geopolitical tension and the Swiss Franc is at all time highs vs the Euro, that is something all together different, I think. This may be unchartered territory, or maybe not. Either way, there is a lot happening in the world, whether that is inflation, currency manipulation, war drums beating, mega cap stocks getting decimated in the matter of a few seconds, we are truly in volatile times. If you were looking to be in Swiss Francs, then you likely might be interested in Gold which is slowly looking like it wants to get going again on the monthly chart above 1880 and the game would be on. This past week I started posting a Trading Lab only (more frequent than weekly) email covering the trading levels for the upcoming trading day, what's in focus for the day, and any new trade ideas, tracking macro and geopolitics. It is only for Lab Members, if you are interested, join us in the Lab! Additionally we are a week in to another Prop Trading Tryout Challenge. We have a number of successful prop traders currently in the Lab and a bunch who are starting out, whether you are interested in prop or not the Currency markets have been excellent the past few weeks and don't look like they'll be cooling off any time soon. |

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.